Real-Time Environment

It enables organizations to amplify the consumer experience from the core and promote access to an integrated configurable environment through a modernized infrastructure, benefitting organizations to enjoy faster development, scalable opportunities, accessible workplace tools, API integration, workflow automation, and much more in a real-time environment.

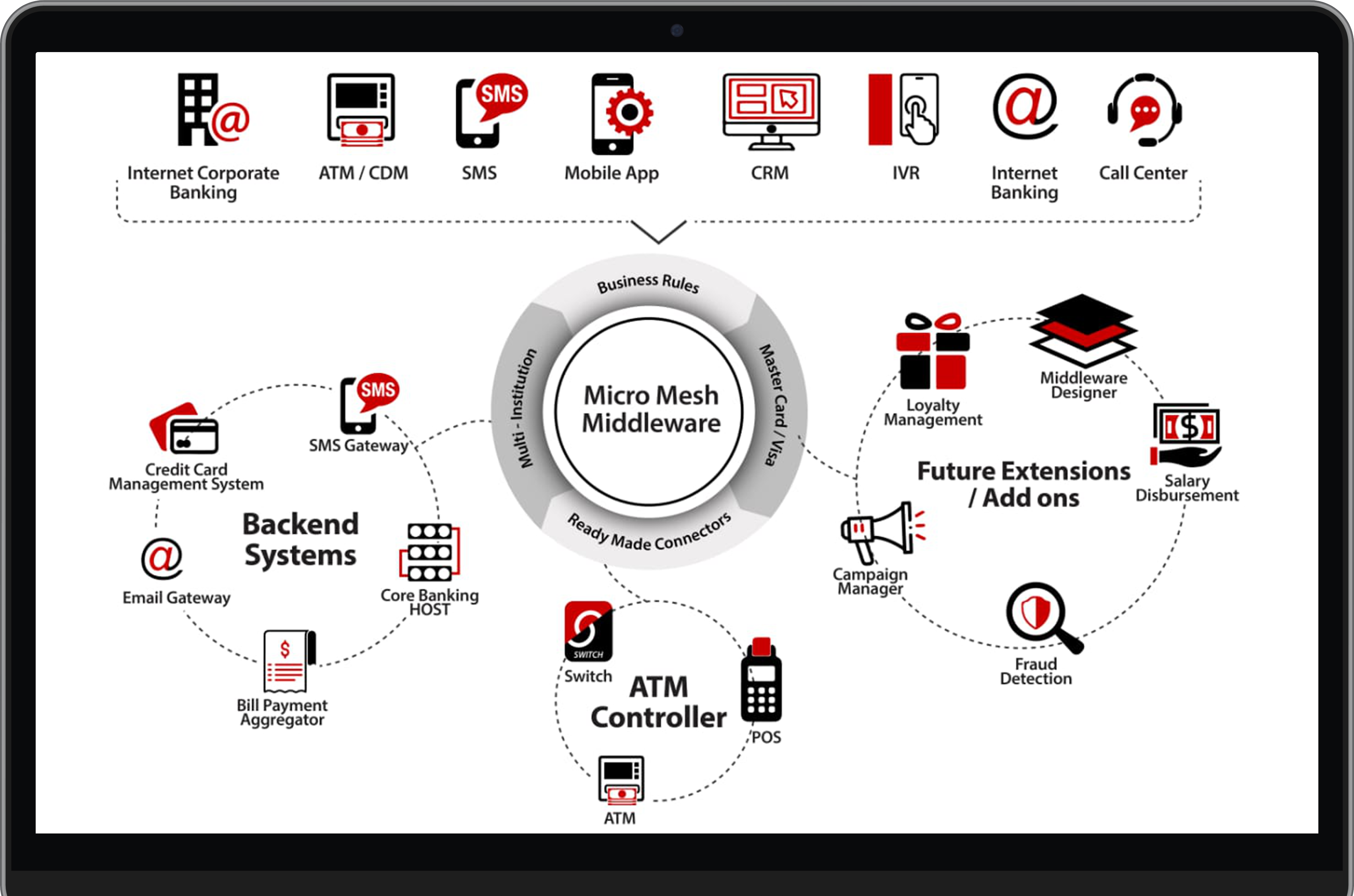

Micro Mesh Middleware – System Overview

Progressive Micro Mesh Middleware

A progressive micro mesh middleware that acts as a gateway between your systems and applications to facilitate enhanced interoperability and data management from all customer touchpoints.

Sits at the center of e-banking infrastructure to connect core systems with delivery channels

Transaction monitoring, trends, analytics, reconciliation, and dispute resolution

Scalable to unlimited number of channels and connectors. Configuration-based message definition.

Micro Mesh Middleware Key Features

Enhanced Security, Verified Trust

Our systems are rigorously validated and certified, meeting the stringent security standards of PCI DSS, Visa, and Mastercard. We implement a robust, multi-layered security architecture, incorporating real-time monitoring, encryption, and advanced fraud prevention mechanisms.